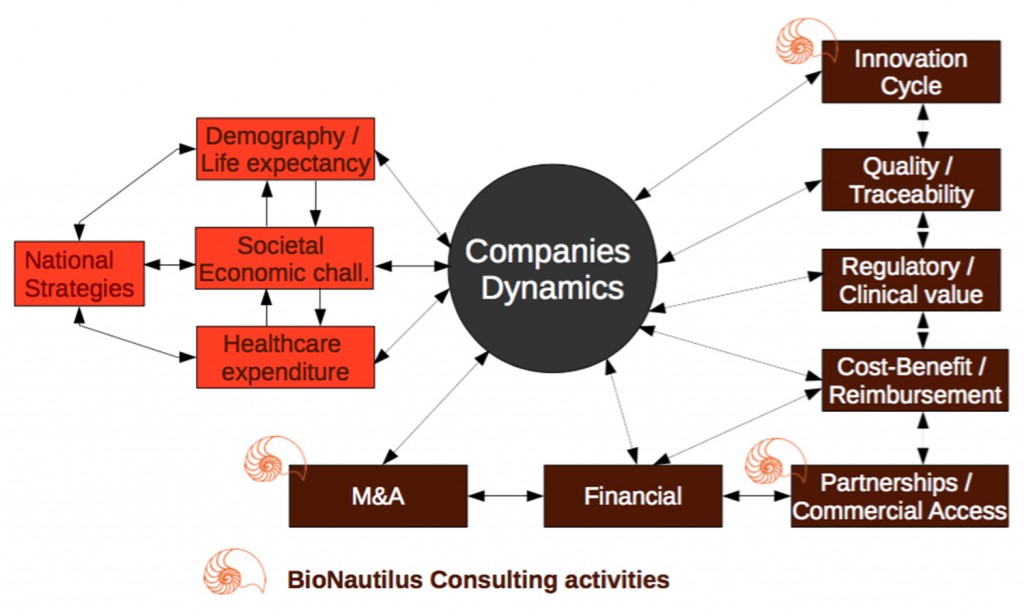

BioNautilus Consulting mainly intervenes in the phases of initial business plan (innovation), commercial access, alliances and M&A:

More detailed elements for those different challenges hereafter:

Life expectancy (sources OECD , 2013)

Life expectancy at the age of 65 reflects the improved quality of healthcare and better lifestyle over the world (as shown in graph)

Societal and economical Challenges lead to new Strategies

In slow growing economies (with some exceptions), but with a still high demand in term of healthcare (organic increase of population, life expectancy, access to innovation…), most of the countries try to adapt their healthcare systems to “deliver more with less or equal budget” and concentrate efforts on the most valuable elements.

The access to new technologies also bring new models and opportunities:

- Home Medical Care (Hospitalization costs represent more than 50% of spending)

- Personalized Medicine (with a Companion Diagnostic strategy e.g.)

- Patient Information Management (Shared information avoiding repeats but needing secure storage and ethic and rapid access for professionals to individual data)

- e-healthcare solutions (for instance connection between different healthcare practitioners and their patients).

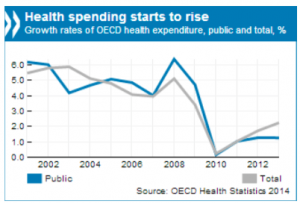

Healthcare expenditure (sources OECD 2015)

With increases in health spending in line with overall economic growth healthcare expenditure as a share of GDP has remained stable on average in OECD countries in the 3 recent years.

But many countries saw healthcare spending below 2009 levels (Greece, Italy, Ireland, Portugal e.g.), when strong spending grow among emerging and booming economies (China, Indonesia, Brazil e.g.)

In absolute numbers, the grow rates expenditure healthcare restarts since 2010 with a total rate slightly above 2% in 2013.

M&A (source: imap Global report Pharma/biotech 2015)

Since 2013, the healthcare sector has seen an acceleration of deals in the pharmaceutical and Medical Devices sectors with M&A top records in 2015:

Pfizer / Allergan: $ 160bn

Medtronics / Covidien: $ 43bn

In 2014, and coming back to consolidated data, the M&A intensity (576 deals) was everywhere with the record in term of money spent in USA (US-based targets), but most of the transactions of 2014 by value and by number of deals involved acquirers located in Western Europe.

In addition to the high level of IPO activity in 2013, it continued with 91 companies going public in 2014, raising US$ 6,4bn.

IPO activity was high in 2013 and continued to be high in 2014 with 91 companies going public, raising US$ 6,4bn.

Innovation

Another challenge is about the Product Life Cycle Management with an acceleration of Innovation and a more rapid obsolescence. Due to breakthrough technologies (Genomics with access to NGS e.g.) combined with increased Data Management capacities, competition is active everywhere including in emerging countries and most of the time not visible in the classical radar scope of the majors.

A significant number of Start-ups are incubated in Bio-Clusters which are more supportive to development aspects with shared facilities and services. There is still a need for those start-ups to master their full ecosystem, and create not only visibility but confidence for potential partners and investors. Innovation is strongly appreciated in combination with a comprehensive business case to attract the right partnerships.

Additionally, Private Equity doesn’t always ask for a formal business plan « carved in stone” and in place before launching a start-up, but is commonly focused on R&D business-building with hands-on engagement from a management team with complementary skills and experience. In another words, business is really part of the earlier stage, and the business plan is quite flexible according to new upcoming events in the Eco-system.

Commercial Access to markets

Market access activities start from the development. It is clearly important to rapidly understand the value of innovation and which markets are planned for the different waves of introduction.

Typically, the selection is made for getting rapid successes and there are different inputs to collect as:

- Science & technology maturity locally (KOL)

- Guidelines – Gold Standards – Recommendations

- Market size and dynamics

- Competition already in place

- Regulatory hurdles (data, translations, costs, time)

- Supply chain

- Organization (with own local resources or partnerships) for the promotion and support

Financial

Access to funding New Start-ups (source: Forbes Pharma-health Dec. 2015)

Geography matters even more today than before. Up-to 90% of Stat-ups are funded locally via Hubs or Bio- Clusters with partners having a collaborative, interactive, incubation-oriented start-up approach.

Business plan & Initial financial projections

Business plans are not always considering different scenarios and assumptions based on different risk assessments at the origin, and financial projections typically look highly aggressive. At best, they are refined as long as the development process is progressing. What is more and more expected from investors is a switch from these refining “business plans” towards practical hands-on business building. Business plans become a continuous living document and rather than attempting to get it perfect from the first version.

Better to be approximately right than exactly wrong!

Now, the management team has to tackle the different dimensions from the Innovation to final “route-to- market”, even the objective of the company is not to go directly and alone to customers.

Regulation

All healthcare companies are acting in a more and more global and highly regulated environment. Initially mainly a contraint in the Pharmaceutical sector, it now also concerns all other activities such as Medical Devices or In Vitro Diagnostics.

These regulations are definitely impacting all steps in the Product Life Cycle Management from the initial discovery through development to commercialization and obviously post-vigilance.

It clearly defines the important milestones of the process. Only a strong and complete Design History System (DHS) can guarantee a good and secure introduction of service or products in the field.

To be successful at the end, the different involved stakeholders, not only marketing, need to think “Glocal” meaning “Think Global and Act Local” and as from the origin of the development.

Clinical Value

The fact-based Clinical Value has to be demonstrated through potentially extensive clinical trials depending on various criteria such as the claims, the concerned disease, prevalence, disease progression over years, etc… To avoid unnecessary trials, and wasted budget and time, the claims need to support the expected unique value covering current unmet needs and not more.

Cost-benefit Analysis & Reimbursement

The demonstration of the Clinical Value is not enough for a “green light” to market.

In the vast majority of countries, the reimbursement system will drive the real introduction.

National Health organizations will deeply analyze the cost-benefit balance, not only for the concerned drugs, product, service, but for the disease management as a whole during the patient experience.

Concretely, that means that this cost-benefit analysis will be conducted versus current practices, guidelines, gold standards, recommendations, local competition depending on countries.

Quality

Quality A Quality system running as a continuum in the full process should comply with the different regulations and local expectations. Registration in one country, even with the most stringent specifications don’t imply an automatic and similar approach for other territories.

Quality Insurance

In case of deviation (internal final QC e.g.) or customer complaints the escalation of actions is as follows: preventive, corrective, withdraw from market and more rarely partial or full re-development.

Follow : on LinkedIn